My readers know that I have focused on exaggerated or fraudulent population-based research on vapor products. But anti-tobacco crusaders have also published numerous studies, predominantly funded by the National Institutes of Health, that widely exaggerate the toxicity of vape aerosols and, through university press releases taken up verbatim by uncritical media, spread like an uncontrollable virus.

There is an antidote, in the form of Dr. Roberto Sussman, an astrophysicist based at the Institute of Nuclear Sciences, National Autonomous University of Mexico. He offers the following review that I am proud to post. BR

The easy publication and wide media diffusion of questionable and unreliable studies is a widespread phenomenon that generates the misperception that e-cigarette aerosols are much more toxic than the evidence shown by well-designed and conducted studies.

Dr Califf has apparently ignored three extensive reviews:

- Soulet, S. and Sussman, R.A. Critical Review of the Recent Literature on Organic Byproducts in E-Cigarette Aerosol Emissions. Toxics, 10, 714.

- Soulet, S. and Sussman, R.A. Critical Review of Recent Literature on Metal Contents in E-Cigarette Aerosol. https://www.mdpi.com/2305-6304/10/9/510 Toxics, 10, 510.

- Sussman, R.A., Sipala, F., Emma, R., and Ronsisvalle, S. Aerosol Emissions from Heated Tobacco Products: A Review Focusing on Carbonyls, Analytical Methods, and Experimental Quality. Toxics 2023, 11, 947.

The reviews provide a critical evaluation of 65 emission studies published between 2018 and 2022 (12 on metals, 36 on organic byproducts and 17 on heated tobacco products, HTPs). The first 2 reviews concern the presence of metals and organic byproducts in e-cigarette aerosols.

To evaluate the 65 reviewed studies, my colleagues and I considered the following 5 conditions of experimental quality: (1) reproducibility and replicability of experiments; (2) consistency between supplied power, coil resistance, airflow rate and puffing parameters; (3) tested devices must be in good conditions; (4) appropriate evaluation of exposure and (5) analytic methods.

We show in the e-cigarette reviews that all studies reporting high levels of toxicants (metals or organic in comparison with toxicological markers) exhibit moderate to severe flaws of experimental design, failing to comply with at least 3 of the 5 quality conditions, making their toxicity assessments either questionable or completely unreliable. As a contrast, all studies complying with (at least) 4 of the 5 quality conditions reported low toxicity levels (below toxicological markers and way below tobacco smoke). Our HTP review showed that all except 2 of the studies (9 industry-funded and 8 independent), are reliable. We also comment and criticize various claims that question the relative safety of HTP aerosols in reference to tobacco smoke.

We believe that these reviews completely demolish all claims of alleged high toxicity of vape aerosols, particularly pronouncements like “contain toxic compounds,” some of which constitute rhetoric devoid of evidence or in some cases they are based on studies that we documented are unreliable.

There are numerous questionable and/or unreliable studies – all funded by the NIH and other public institutions in the US – that are widely cited in order to promulgate the sense of a toxic crisis. Here are some of the worst offenders (citation numbers taken from Google Scholar):

Olmedo, P., Goessler, W., Tanda, S., Grau-Perez, M., Jarmul, S., Aherrera, A., ... & Rule, A. M. (2018). Metal concentrations in e-cigarette liquid and aerosol samples: the contribution of metallic coils. Environmental health perspectives, 126(2), 027010. 329 citations

Bitzer, Z. T., Goel, R., Reilly, S. M., Elias, R. J., Silakov, A., Foulds, J., ... & Richie Jr, J. P. (2018). Effect of flavoring chemicals on free radical formation in electronic cigarette aerosols. Free Radical Biology and Medicine, 120, 72-79. 151 citations

Kim, S. A., Smith, S., Beauchamp, C., Song, Y., Chiang, M., Giuseppetti, A., ... & Kim, J. J. (2018). Cariogenic potential of sweet flavors in electronic-cigarette liquids. PloS one, 13(9), e0203717. 109 citations

Zhao, D., Navas-Acien, A., Ilievski, V., Slavkovich, V., Olmedo, P., Adria-Mora, B., ... & Hilpert, M. (2019). Metal concentrations in electronic cigarette aerosol: Effect of open-system and closed-system devices and power settings. Environmental research, 174, 125-134. 94 citations

Bitzer, Z. T., Goel, R., Reilly, S. M., Foulds, J., Muscat, J., Elias, R. J., & Richie Jr, J. P. (2018). Effects of solvent and temperature on free radical formation in electronic cigarette aerosols. Chemical research in toxicology, 31(1), 4-12. 88 citations

Son, Y., Mishin, V., Laskin, J. D., Mainelis, G., Wackowski, O. A., Delnevo, C., ... & Meng, Q. (2019). Hydroxyl radicals in e-cigarette vapor and e-vapor oxidative potentials under different vaping patterns. Chemical research in toxicology, 32(6), 1087-1095. 67 citations

Son, Y., Bhattarai, C., Samburova, V., & Khlystov, A. (2020). Carbonyls and carbon monoxide emissions from electronic cigarettes affected by device type and use patterns. International journal of environmental research and public health, 17(8), 2767. 64 citations

Ooi, B. G., Dutta, D., Kazipeta, K., & Chong, N. S. (2019). Influence of the e-cigarette emission profile by the ratio of glycerol to propylene glycol in e-liquid composition. ACS Omega 4 (8): 13338–13348, PMID: 31460462. 62 citations

Korzun, T., Lazurko, M., Munhenzva, I., Barsanti, K. C., Huang, Y., Jensen, R. P., ... & Strongin, R. M. (2018). E-cigarette airflow rate modulates toxicant profiles and can lead to concerning levels of solvent consumption. ACS omega, 3(1), 30-36. 60 citations

Tehrani, M. W., Newmeyer, M. N., Rule, A. M., & Prasse, C. (2021). Characterizing the chemical landscape in commercial e-cigarette liquids and aerosols by liquid chromatography–high-resolution mass spectrometry. Chemical research in toxicology, 34(10), 2216-2226. 57 citations

El-Hellani, A., Al-Moussawi, S., El-Hage, R., Talih, S., Salman, R., Shihadeh, A., & Saliba, N. A. (2019). Carbon monoxide and small hydrocarbon emissions from sub-ohm electronic cigarettes. Chemical research in toxicology, 32(2), 312-317. 48 citations

Fowles, J., Barreau, T., & Wu, N. (2020). Cancer and non-cancer risk concerns from metals in electronic cigarette liquids and aerosols. International journal of environmental research and public health, 17(6), 2146. 47 citations

Williams, M., Li, J., & Talbot, P. (2019). Effects of model, method of collection, and topography on chemical elements and metals in the aerosol of tank-style electronic cigarettes. Scientific Reports, 9(1), 13969. 46 citations

Here are two studies (one of them cited above) with misleading conclusions that have been widely cited, while corresponding articles dealing with their deficiencies have been ignored.

Misleading: Williams, M., Villarreal, A., Bozhilov, K., Lin, S., & Talbot, P. (2013). Metal and silicate particles including nanoparticles are present in electronic cigarette cartomizer fluid and aerosol. PloS one, 8(3), e57987. 825 citations

Ignored: Farsalinos, K. E., Voudris, V., & Poulas, K. (2015). Are metals emitted from electronic cigarettes a reason for health concern? A risk-assessment analysis of currently available literature. International journal of environmental research and public health, 12(5), 5215-5232. 118 citations

Misleading: Olmedo P, Goessler W, Tanda S, et al. Metal Concentrations in e-Cigarette Liquid and Aerosol Samples: The Contribution of Metallic Coils. Environ Health Perspect. 2018 Feb 21;126(2):027010. doi: 10.1289/EHP2175. PMID: 29467105; PMCID: PMC6066345. 329 citations

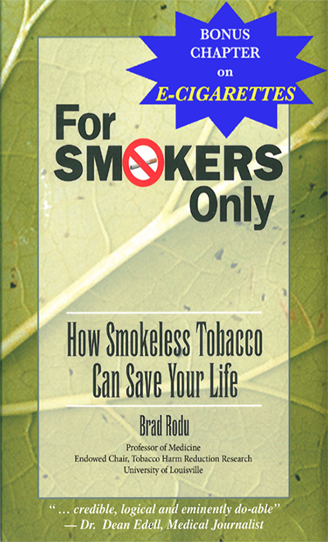

Ignored: Farsalinos KE, Rodu B. Metal emissions from e-cigarettes: a risk assessment analysis of a recently-published study. Inhal Toxicol. 2018 Jun-Jul;30(7-8):321-326. doi: 10.1080/08958378.2018.1523262. Epub 2018 Nov 2. PMID: 30384783. 15 citations

Another important distinction between the last two articles can be seen by their Altmetrics Score, which is a measure of how much attention they have received. The Altmetrics Score of the Olmedo et al article is 46,891. In contrast, the score of the article by Farsalinos and Rodu is 139.

Stay tuned. We have submitted a review of 98 studies (some widely cited) that have tortured cells/rodents by exposing them to overheated and carbonyl-loaded aerosols, which evidently renders their assessment of vaping safety totally unrealistic and unreliable.

The articles I have highlighted represent just the tip of the anti-tobacco harm reduction iceberg that is killing smokers all over the world.